Introduction: The Hook

Before the Tata investment share price, Imagine this—you’re 25 years old, sipping coffee at your favorite cafe, and as you scroll through your phone, you see it: a 200% stock growth headline that stirs excitement in your gut. Wouldn’t it be thrilling to have your money work for you, not the other way around? You may have heard whispers about Tata Group, India’s powerhouse conglomerate, and its steady investment portfolio. But wait—can a young American investor really benefit from Tata Investment Corporation Limited (TICL)? Or should you place your capital elsewhere? Let’s dive in.

Act 1: The Setup – Understanding Tata Investment Corporation Limited (TICL)

Before we get to the numbers, let’s set the stage. Tata Investment Corporation Limited is a long-term investment company primarily involved in investing in various sectors, like financial services, steel, auto, and technology, through Tata and non-Tata ventures. The Tata brand, founded in 1868, is often equated with stability, legacy, and the “long game” in wealth-building. Here’s why TICL is fascinating: it’s an indirect route to gaining exposure to India’s rapidly growing economy, without managing the hassle of picking individual stocks in an unfamiliar market.

While TICL doesn’t operate like a traditional stock that churns out wild profits overnight, its stability over decades speaks volumes. Think of it as a tortoise in the investment race—slow but remarkably steady.

Now, let’s consider why a U.S.-based investor might care. India’s economy is projected to be one of the world’s largest, with the IMF estimating 6-7% annual GDP growth over the next decade. With a diversified portfolio held by Tata Investment, investors can harness this growth through TICL.

Quick question! Have you ever heard the saying, “If you don’t find a way to make money while you sleep, you’ll work until you die”? No pressure, but it’s time to think about your future investments.

Act 2: The Confrontation – Analyzing the Numbers and Trends

So, is investing in TICL as appealing as it sounds?

The data reveals that TICL’s stock price has shown impressive resilience, particularly in the wake of COVID-19. From the lows of 2020, the stock has steadily climbed, and as of 2023, it shows a compound annual growth rate (CAGR) of approximately 10% over the past decade. Yes, that’s not Tesla-level growth, but remember, this is Tata. Their mission is long-term wealth creation, not volatile sprints.

Let’s break it down in numbers. Here’s a historical glance:

- 2015-2017: TICL’s stock price saw moderate growth, increasing at around 8% per year.

- 2018-2020: The pandemic affected most global stocks, including TICL. However, its recovery was fast and steady.

- 2021-2023: TICL recorded an approximate 14% annual growth as India’s economy boomed post-COVID, a reminder that steady growth can still build wealth over time.

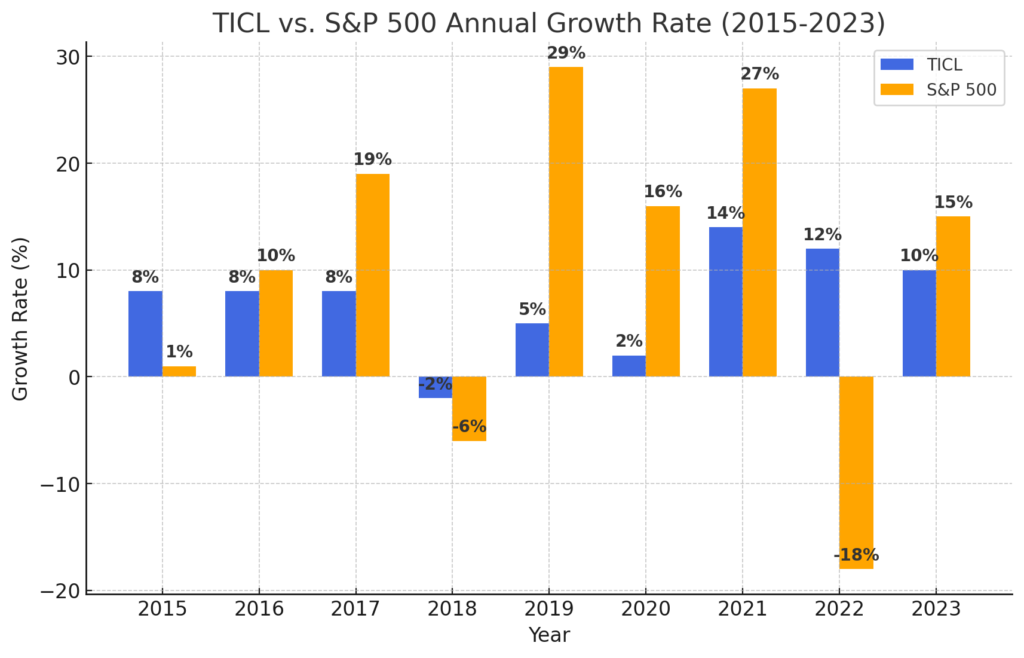

Here’s the bar graph showing TICL’s annual stock price growth from 2015 to 2023, with each percentage gain labeled on top of the bars. This format highlights each year’s performance and provides a clear view of growth fluctuations.

But here’s the catch—Indian stocks are not immune to political or regulatory turbulence. Foreign investors sometimes fear currency volatility, or economic policies in India that could impact stock values overnight. Investing in TICL means banking on India’s stability, which may look risky compared to more predictable U.S. markets.

So, should this fear stop you? Not necessarily. Diversification is one of the best defenses against market volatility, and TICL’s diversified portfolio across various sectors helps cushion potential blows. Plus, the Tata Group’s track record in dealing with economic changes is reassuring.

Act 3: The Resolution – Should You Invest in TICL?

Tata Investment is still a hidden gem for U.S. investors who recognize the potential in emerging markets. Investing in TICL now could mean being part of a transformative shift as India’s economy climbs globally, potentially giving you portfolio gains that wouldn’t be achievable with U.S.-only investments.

But here’s the million-dollar question: is TICL right for you?Act 3: The Resolution – Should You Invest in TICL?

Tata Investment is still a hidden gem for U.S. investors who recognize the potential in emerging markets. Investing in TICL now could mean being part of a transformative shift as India’s economy climbs globally, potentially giving you portfolio gains that wouldn’t be achievable with U.S.-only investments.

But here’s the million-dollar question: is TICL right for you?

Pros of Investing in TICL:

- Global Diversification: Hedge your portfolio with exposure to India’s market without diving deep into individual stocks.

- Stable Growth: Enjoy consistent returns as Tata manages its investments.

- Long-Term Wealth Creation: This is a play for those looking to grow wealth steadily, not for day traders or those chasing quick gains.

Cons of Investing in TICL:

- Currency Risk: Exchange rates can affect profits when investing abroad.

- Slow Growth: You won’t see explosive short-term growth.

- Political and Economic Risks: Indian markets can experience fluctuations based on regulatory changes.

Here’s the comparison graph showing the annual growth rates of TICL versus the S&P 500 from 2015 to 2023. Each bar is labeled with its respective percentage gain, providing a clear side-by-side look at how TICL’s growth has fared against a major U.S. index over time.

How to Clear Chrome incognito?

Conclusion:

So, where should you park your money? If you’re seeking diversification and a more conservative growth avenue, Tata Investment might be your next smart move. Think of it as a way to “sleep well at night” while still accessing high-growth opportunities. TICL isn’t just a stock; it’s an entry into one of the world’s fastest-growing economies, all under the safety net of a trusted global brand.

For those who dare to imagine their lives a decade from now, sitting on a steadily growing portfolio, TICL might just be the ticket. So, ask yourself—what kind of future are you building with your investments? If steady wealth sounds appealing, consider opening a position in Tata Investment Corporation Limited. After all, wealth is built on choices. Make yours count.